Assalamu Alaikum girlie! 🌺

Are you driving away your million dollar retirement fund?

Well, ~40% of Americans have car loans (Nasdaq, 2023), but does the average person really understand the numbers behind it?

I’ll break it down for you.🚗💰

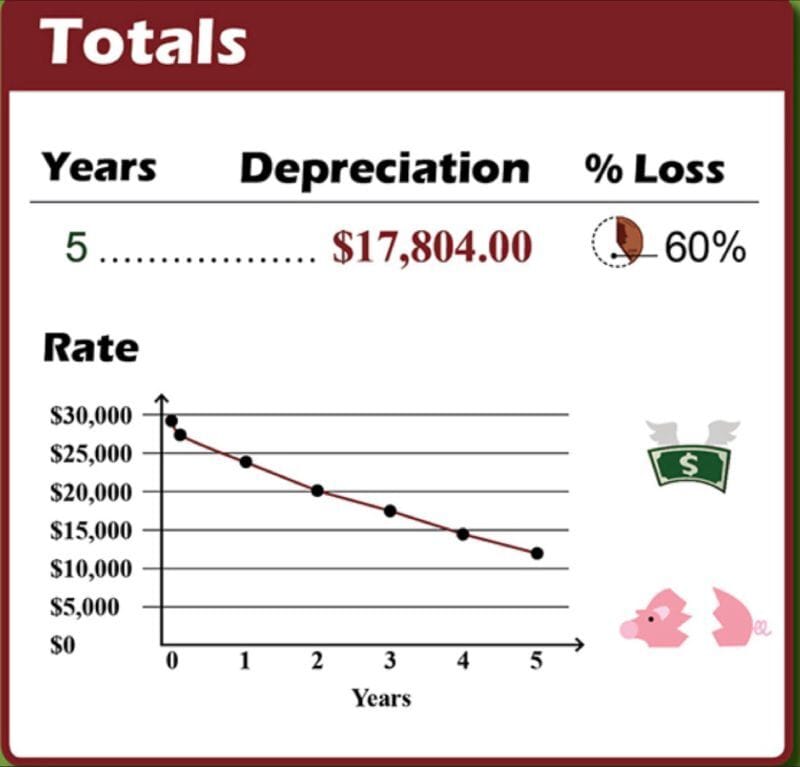

Cars Lose 60% of it’s Value in 5 Years

Did you know that cars can lose a 60% of their value in just 5 years?

Let's understand this with an example:

📉 let’s say you bought a car worth $30,000 in 2024.

In 2025, it’ll be worth ~ $24,186. (🔻19%)

In 2027, it’ll be worth ~ $17,406. (🔻42%)

In 2029, it’ll be worth ~ $12,069. (🔻60%)

The $30,000 car might depreciate more based on factors like mileage, condition, and market demand.

Factors That Affect the Monthly Payment

The average car payment is ~ $533 for used cars and ~ $726 for new ones‼️ (Bankrate, 2024)… ouch!🤯

Here are 3 Factors that Affect the Payment:

1️⃣ Down Payments and Trade-In Value: A substantial down payment can significantly reduce your monthly payments and the overall loan cost.

2️⃣ Loan Amount: The more you borrow, the higher your monthly payments will be. It's simple math—less debt means less stress on your wallet!

3️⃣ Loan Term: Longer loan terms may have lower monthly payments, but they often come with a higher total cost. On the flip side, shorter loan terms mean higher monthly payments but potential savings in the long run.

Investing hack: If you buy a used car in cash, and invested $500/month in an average mutual fund from 2024-2029. In 2029, your investment would be worth ~ $38,361.81 (🔺9.24% each year). Which will be well over $1M with after a few decades

5 Pro-Tips on Buying a Car in Cash

🕵️Research, Research, Research: buckle up- you’re in detective mode. Learn about the car, look at reviews, reliability ratings, and common issues to avoid any unpleasant surprises down the road.

🔎Inspect Thoroughly: Don't be deceived by the looks— hire a trusted mechanic to perform an in-depth pre-purchase inspection to catch any potential red flags.

📖 Check the Vehicle History Report: Use resources like Edmunds to check a vehicle’s history report to uncover any past accidents, title issues, or odometer discrepancies.

🤝 Negotiate Wisely: Don't be afraid to negotiate the price! Research the market value of similar cars and use this information to negotiate a fair price.

pro tip: Don’t sound desperate to the dealer.

💰Build An E-Fund for Repairs: Even the most reliable used cars will need repairs. Build an emergency fund for ongoing maintenance and unexpected repairs to keep your car alive.

Gif by christopherrutledge on Giphy

and until next time…

Drive safely and spend wisely,

Fatimah✨

p.s. use the link below to share this with your friends & family!