Assalamu Alaikum! 🌸

Today’s topic is probably the most disliked yet unavoidable expense for most adults. You guessed that right- the good taxes!

While paying taxes is required, understanding the different types allows you to plan better and make informed decisions.

Here’s what we’ll cover:

5 Types of Taxes

Other things to know About Taxes

** note: this content is intended for educational purposes only, not tax advice

5 Types of Taxes

📊 1. Income Tax

Income tax is what most of us are familiar with. It’s a tax on the money you earn from work or investments. The government collects this tax to fund services like education, healthcare, and infrastructure.

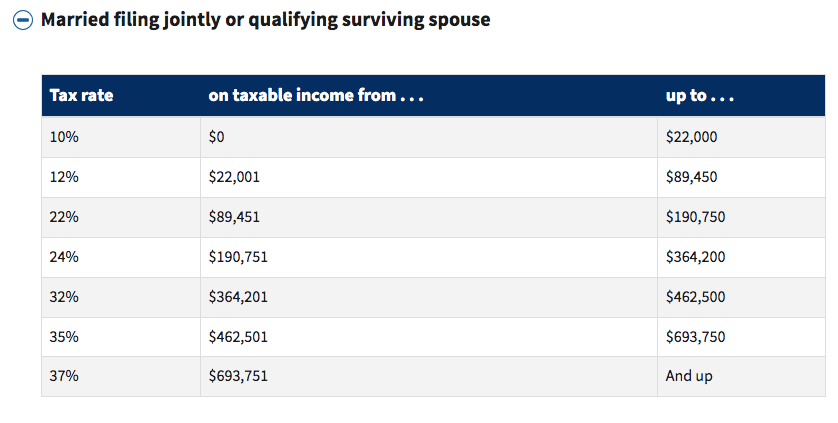

Income tax rates vary depending on how much you earn, with higher earners paying more. Here are the 2023 federal tax rates:

source: irs.gov

source: irs.gov

Key tip: If you’re employed, your employer usually withholds income tax from your paycheck, but if you're self-employed, it's important to set aside money for quarterly tax payments.

📈 2. Capital Gains Tax

If you’ve ever sold an investment like stocks or even property, you may have heard of capital gains tax. It’s a tax on the profit you make from selling an asset for more than you bought it after a certain period of time.

Short-term vs. Long-term: Short-term capital gains (assets held for less than a year) are taxed at your regular income tax rate, while long-term gains (assets held for more than a year) generally have a lower tax rate.

🏡 3. Property Tax

If you own a home or any real estate, property taxes are part of the deal. These taxes help fund local government services like schools, roads, and emergency services.

How it works: Property taxes are typically calculated based on the value of the property. The higher your home’s assessed value, the more you pay in property taxes.

🎁 4. Gift Tax

Did you know that giving away large gifts could trigger taxes? Gift tax is imposed on the transfer of property or money to another person without expecting anything in return.

Annual exemption: You can give up to a certain amount each year (currently $18,000 in 2024) without paying gift tax [source: irs.gov].

Key tip: Giving under the annual exemption is a great way to transfer wealth without triggering gift tax, especially when planning for sadaqah or family support.

5. Payroll Tax

Payroll tax is usually taken directly from your paycheck and goes toward Social Security and Medicare, which provide retirement benefits and healthcare for older adults. Both employees and employers pay into this system.

FICA: Payroll taxes are often referred to as FICA taxes, which stands for the Federal Insurance Contributions Act. As an employee, 6.2% goes toward Social Security, and 1.45% is for Medicare (your employer matches these contributions) [source: irs.gov].

Key tip: If you're self-employed, you may pay both the employer and employee portions of payroll tax depending on how you structure your payments.

Other Things to Know About Taxes

Self-employment Tax: If you're running your own business or freelancing, you’re responsible for paying both the employer and employee portions of payroll taxes.

Setting aside money throughout the year can help you avoid a big tax bill in April.

Sales Tax: This is a tax on goods and services you buy. Sales taxes vary depending on the state you live in, with some states not charging any sales tax at all.

Tax Deductions and Credits: While there’s a lot of talk about paying taxes, don't forget about tax deductions and credits that can reduce your tax bill.

For example, donations to charities can sometimes be deducted from your taxable income. Work with a CPA for the best advice.

Tax-Deferred Accounts: Using tax-deferred accounts like traditional IRAs and 401(k)s for retirement savings puts off your taxes to be paid out in the future.

This means that all the growth you earn on your investments will be taxed in the future!

Gif by pudgypenguins on Giphy

Staying organized is the key to handling taxes without the headache. Keep all important documents, receipts, and records in one place so you’re prepared when tax season arrives. Get a good CPA in your corner.

Until next week, keep Uncle Sam happy and pay your taxes! 😄

Best,

Fatimah ✨

Founder, Finance Girlie